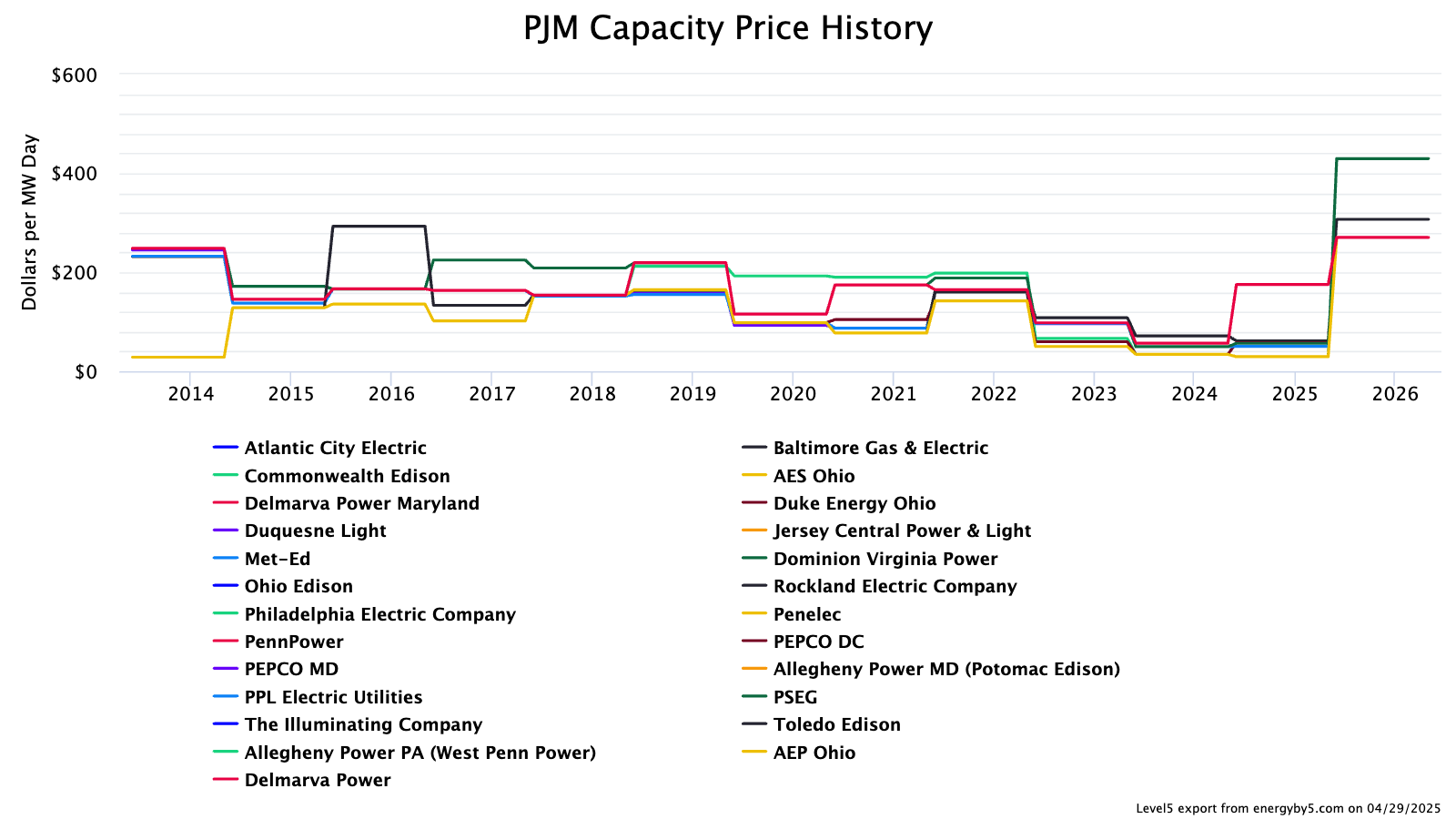

(Photo credit: Level5 by 5)

May 1, 2025

Energy portfolio managers in the PJM market whose monthly spend exceeds $5,000 may need to adjust their energy procurement strategy. For large load power procurement beyeond May 2026, I recommend passing through capacity and transmission costs, even for fixed-price contracts.

Dramatic price increases and related rule changes in PJM capacity markets call for adjustments to large load energy strategy.

Using AEP Ohio as a proxy for the entire PJM market, capacity prices increased about 10X between the June 2024 and July 2025 auctions (Figure 1).

Figure 1. PJM Capacity Price History for AEP Ohio (Credit: Level5 by 5)

Power capacity markets are intended to ensure long-term grid reliability by incentivizing the development and maintenance of power generation assets. Capacity markets are often compared to an insurance policy where power consumers receive additional protection from power shortages and price spikes in exchange for a modest increase in power prices.

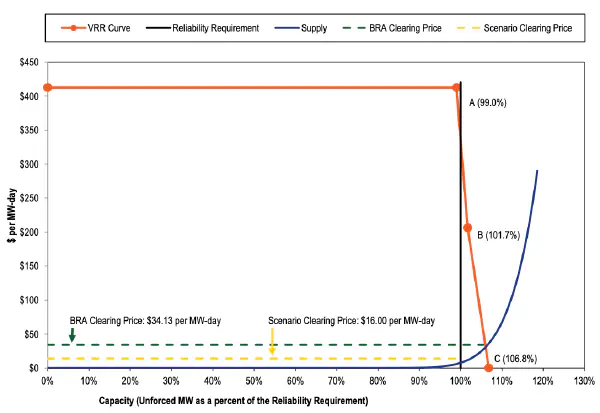

PJM’s capacity market is called the Reliability Pricing Model. Under this model, “[generation] resources must deliver on demand during system emergencies or owe a significant payment for non-performance (PJM Learning Center, 2025). The capacity market is managed through a competitive auction where capacity prices are directed by the Variable Resource Requirement Curve (VRR) and vary based on geography and transmission constraints (Figure 2).

Figure 2. Shape of the PJM VRR curve relative to the reliability requirement, 2023-2024 RPM Base Residual Auction (Figure 1 from Analysis of the 2023-2024 RPM Base Residual Auction by Monitoring Analytics (2022)

The PJM capacity shortfull and corresponding price increases are driven by multiple factors including the addition of significant commercial demand (i.e., data centers), the retirement of fossil-fuel based generating capacity, and delays in the devolpment of new generation and transmission capacity.

These factors are further explained in Understanding PJM’s Capacity Rule Changes: Implications for Auction Prices and Grid Reliability (5, 2025).

5’s April 28, 2025 blog post, What a 5X increase in PJM capacity costs means for your elecric bill lists three strategies to mitigate capacity costs increases. Below, I repeat 5’s strategies, with my own commentary on the third strategy.

An upgraded procurement strategy makes particular sense for facilities and operations whose energy budget is a dominant line item. For large load power procurement beyond May 2026, I recommend passing through capacity and transmission costs, even for fixed-price contracts.

Suppliers will offer contracts which, at face value, include fixed price capacity and transmission charges. Take this with a large gain of salt. The settlement price of future capacity auctions is unknown and suppliers are permitted to pass these costs on to the consumer, even for fixed-price contracts.

Zac Coventry specializes in energy portfolio management for large loads. He helps developers and operators reduce CapEx and operational costs through supply chain management, energy brokerage, and strategic advising.

For a private consultation, please contact me.