Digital Energy Brief

Dec 5, 2025

Estimated reading time: ~6 minutes

HEADLINES (TEXAS ENERGY)

ERCOT POWER MARKET

NATURAL GAS (NYMEX)

WEATHER

The structural story in Texas this week is all about large flexible load. ERCOT’s latest analysis – echoed by retail and consulting shops – has large-load interconnection requests jumping from ~56 GW in late 2024 to nearly 205 GW by November 2025, driven by AI data centers, Bitcoin mining, and energy-intensive manufacturing. That’s more than twice today’s ~87 GW peak load and is forcing ERCOT and the PUCT to tighten interconnection standards, accelerate transmission planning, and implement Senate Bill 6 rules that push big loads to shoulder more grid costs and backup obligations (ERCOT Monthly Report).

PERSPECTIVE

Figure 1. ERCOT highlights | December 05, 2025

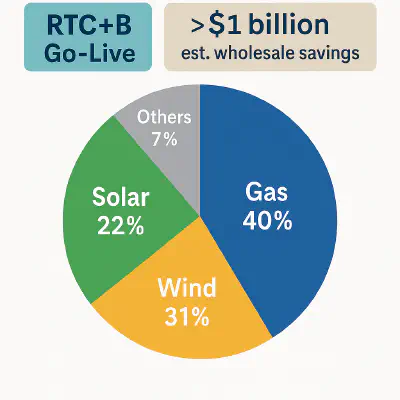

Structurally, December 5 is a watershed day for ERCOT: Real-Time Co-optimization plus Batteries (RTC+B) moves from trial to production. Under RTC+B, ERCOT will co-optimize energy and ancillary services in real time, rather than treating ancillary commitments as a largely “frozen” artifact of the Day-Ahead Market. ERCOT’s own analysis and third-party studies suggest the change could have cut wholesale costs by roughly 19% (about $6.5B) over a recent 12-month backtest, and forward-looking estimates put steady-state savings north of $1B per year (ERCOT Board RTC+B Update).

This efficiency push is arriving just as the system gets structurally weird in two directions at once. On the supply side, ERCOT is digesting a wave of new renewables and batteries; on the demand side, large flexible loads tied to AI and crypto are expanding far faster than historical load growth, with ERCOT’s capacity, demand and reserves (CDR) work and recent planning presentations flagging 40+ GW of additional peak demand this decade (EIA Today in Energy). Enverus and others are already documenting falling battery revenues as the BESS market saturates – RTC+B will likely sharpen those economics further by making ancillary pricing more efficient (PV Magazine).

For customers, November pricing has actually been relatively benign. Analysis from ElectricSaveTX pegs average residential rates around 15.4 ¢/kWh (all-in, including TDU charges), below the U.S. average, with wholesale forward curves showing lower average 2025 prices than 2024 but continued premium summer peaks in 2026 (ElectricSaveTX). Short version: structure is changing fast, but the near-term takeaway is “more optionality” rather than “imminent crisis” – especially for loads with flexibility and appetite for indexed or hybrid structures.

PERSPECTIVE

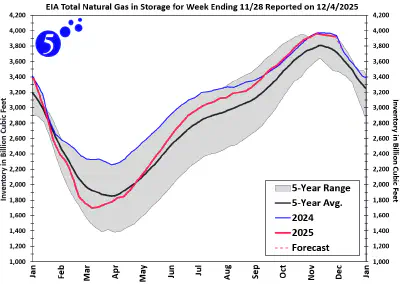

Figure 2. EIA’s weekly natural gas storage report for week ending 2025-11-28

(Credit: 5’s Zoltar team using data published by the U.S. Energy Information Administration)

Prompt-month Henry Hub has staged a very un-2024-like comeback. After languishing below $3/MMBtu for much of late summer and early fall, monthly averages climbed into the low-$3s by October and then jumped again – Reuters pegs November’s average around $4.47/MMBtu, with spot prints in early December pushing above $5 as heating load, record LNG feedgas and an Arctic air mass collide (Reuters). Desk commentary from 5’s Zoltar team notes that since Wednesday, Q1 2026 NYMEX natural gas prices have rallied by about $0.60/MMBtu, while 2027 strips are only around $0.08 higher, underscoring how the market is concentrating weather risk into the next couple of storage reports and the front half of 2026.

EIA’s latest Short-Term Energy Outlook still frames this move as a “normal” winter tightening on top of strong export demand: they expect Henry Hub to average just under $3.90/MMBtu across the November–March window, then climb toward ~$4.00/MMBtu in 2026 as LNG capacity expands (EIA STEO – Natural gas).

Fundamentals, however, still look comfortable in the near term. Working gas in storage stands at 3,935 Bcf for the week ending November 21, – 160 Bcf above the five-year average, even after the first modest 11 Bcf withdrawal (EIA Weekly Storage). That modest cushion is competing with more bullish forces: November U.S. LNG exports hit a record 10.9 million metric tonnes, with liquefaction demand touching 18–19 Bcf/d, and margins are tight enough that traders are openly debating how much further HH can rise before export economics start to bite (Reuters).

For Texas end-users, the translation is straightforward: this winter’s gas market is no longer the ultra-cheap 2024 story. Storage is still friendly, but between polar outbreaks, record LNG, and higher forward price decks from EIA, fixed-price opportunities now live in a “value” band, not a fire sale.

PERSPECTIVE

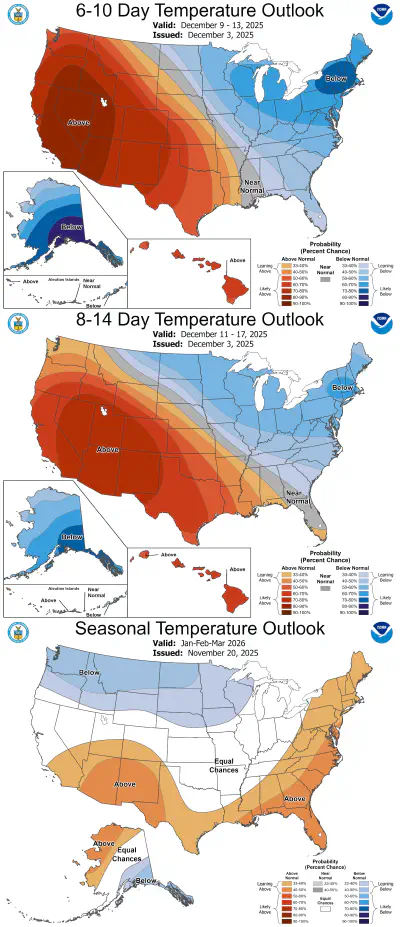

Texas started December on the chilly side of the ledger. San Antonio, Houston, and much of North and West Texas saw highs running 10–15°F below normal and some of the coldest readings since last winter, with parts of the Panhandle and North Texas dipping into the teens (MySanAntonio). That cold shot is part of a broader continental pattern: a disrupted polar vortex and strong Arctic air outbreak are driving widespread sub-freezing temperatures and record-threatening lows across the Midwest and East (Weather.com).

Looking ahead, CPC’s 6–10 and 8–14-day outlooks, along with week-3/4 guidance, lean toward above-normal temperatures across much of the southern tier, including Texas, as La Niña continues to organize the winter pattern (NOAA CPC – 8–14 Day Outlook). Local forecasts echo that story: after this initial cold stretch, South and Central Texas are expected to spend mid-December a few degrees above seasonal norms, with oscillating fronts rather than a locked-in Arctic regime (Austin American-Statesman).

For ERCOT, this blend of early cold and then a milder, more variable mid-month is neither a classic bear nor bull pattern. It justifies some winter risk premium – especially as gas prices firm – but doesn’t scream “February 2021.” Operationally, the action will be in how RTC+B interacts with winter scarcity events: brief cold snaps plus stronger batteries and co-optimization may create new, sharper pricing signatures even without a blockbuster storm.

Figure 3. NOAA 6-10 Day, 8-14 Day, and Seasonal Temperature Outlooks

This post is provided for informational purposes only. Digital Energy Brief and Coventry Enterprises, LLC make no warranty, express or implied, regarding the accuracy or completeness of the information herein.

The Digital Energy team specializes in site development and energy strategy for large power loads, including data centers and cryptocurrency mining. For a list of available data center and cryptocurrency mining sites, see our Marketplace section. For a private consultation, please send us a message.